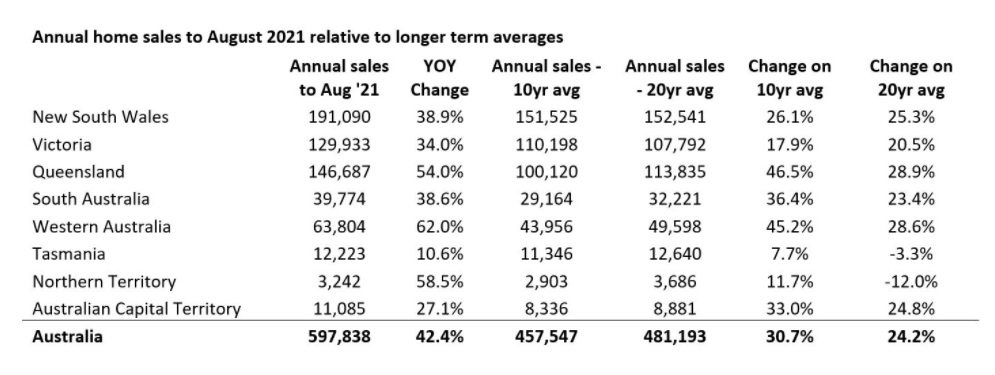

According to CoreLogic estimates there were almost 598,000 house and unit sales across Australia over the year ending August 2021; the highest number of annual sales since 2004 and a 42% lift on the annual number of sales over the previous 12-month period. Nationally, the number of dwellings sold over the past year was 31% above the decade average and 24% higher than the 20-year average.

Across the states, annual home sales are substantially higher than a year ago, with every

state and territory, apart from Tasmania, recording a lift of more than 10% in year-on-year home sales. The smaller increase in sales across Tasmania, where advertised supply was tracking approximately 35% below average at the end of August, is probably more attributable to a lack of supply than a shortage of demand.

Such a significant surge in housing demand may seem surprising at a time when overseas

migration has stalled, however the substantial rise in home sales can be explained by a lift in domestic demand from previously low levels.

Housing

turnover (annual home sales as a percentage of total dwellings) trended lower

from late 2015 as credit conditions tightened, housing affordability became more challenging and transaction costs such as stamp duty became increasingly expensive as prices rose. National turnover reached a record low in June 2019 when only 3.7% of Australian homes

transacted over the year. Since then credit policies have loosened and mortgage rates have reduced to record lows, encouraging more Australians to participate in the housing market. Additionally, a higher rate of household savings since March 2020 has boosted consumer deposit levels and mortgage serviceability, while government incentives such as stamp duty concessions and deposit guarantees have also supported demand.

Longer term, a move away from property transaction disincentives, such as stamp duty, would

help to support higher turnover. Previous research from CoreLogic showed transactional costs, along with raising a deposit, were the biggest barriers to housing affordability. It’s encouraging to see state governments in the ACT, SA and NSW transitioning away from stamp duty, albeit with different strategies and progress, which should help to remove disincentives for home owners and prospective buyers to transact in the housing market.

Property Pulse Newsletter 20/09/2021

Powered by ReNet - Software designed by Real Estate Agents, for Real Estate Agents